Consolidation & Regulatory Change in Dialysis: How Does It Impact You?

Download (.zip)

Presented by Vern Taaffe at the 2006 National NANT Symposium in Las Vegas, NV.

Thank you, Mark and good morning everyone. I have a short slide presentation to share with you. The objective for this presentation is to give you an industry perspective on how the consolidation and regulatory changes in dialysis may impact you and your vendors.

Thank you, Mark and good morning everyone. I have a short slide presentation to share with you. The objective for this presentation is to give you an industry perspective on how the consolidation and regulatory changes in dialysis may impact you and your vendors.

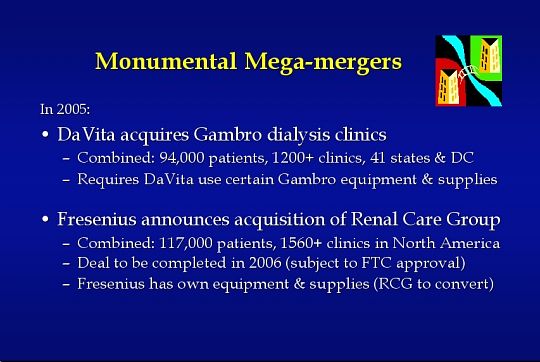

This slide and the next slide list some of the details of the “Monumental Mega-mergers” and the regulatory changes.

Mark Neumann has already provided an excellent overview of the consolidation and regulatory changes; therefore, we will skip through this slide and the next slide.

It is important to note that the DaVita/Gambro deal requires DaVita to use certain Gambro products for a minimum of 10 years. In addition, Fresenius is vertically integrated in that they manufacture, stock, and sell mostly their own equipment and supplies to their own dialysis clinics.

Mark Neumann has already provided an excellent overview of the consolidation and regulatory changes; therefore, we will skip through this slide and the next slide.

It is important to note that the DaVita/Gambro deal requires DaVita to use certain Gambro products for a minimum of 10 years. In addition, Fresenius is vertically integrated in that they manufacture, stock, and sell mostly their own equipment and supplies to their own dialysis clinics.

Here is a list of the ESRD regulatory revisions associated with the Medicare Modernization Act of 2003. Mark covered this well.

In the near term (next 1 or 2 years), how will the consolidation and regulatory changes affect Technicians/Technologists?

Will it help or hurt?

Will it help or hurt?

Because this question is subjective in nature, you may receive different answers depending on who you talk to. Therefore — in addition to my own views — I thought it would be very important to solicit and include input from several key people.

Each of the contributors listed here have 25 plus years of combined experience working for industry vendors and working as dialysis technicians.

Bruce Farrow of National Renal Alliance, and formerly of Marcor, also contributed input to the impact question.

Each of the contributors listed here have 25 plus years of combined experience working for industry vendors and working as dialysis technicians.

Bruce Farrow of National Renal Alliance, and formerly of Marcor, also contributed input to the impact question.

Let’s take a look at how the consolidation and regulatory changes can be expected to help technicians and technologists:

• A more stable work environment will emerge as further mega-mergers will be unlikely. Independent providers and small chains are less likely to be acquisition targets as the “big 2” work through the details of consolidation.

The following points refer to the work environment in the consolidated companies:

• Technical expertise and resources will be more concentrated and are likely to be more plentiful.

• There will be more opportunities to relocate while maintaining benefits such as health insurance, vacations, seniority, etc.

• A more stable work environment will emerge as further mega-mergers will be unlikely. Independent providers and small chains are less likely to be acquisition targets as the “big 2” work through the details of consolidation.

The following points refer to the work environment in the consolidated companies:

• Technical expertise and resources will be more concentrated and are likely to be more plentiful.

• There will be more opportunities to relocate while maintaining benefits such as health insurance, vacations, seniority, etc.

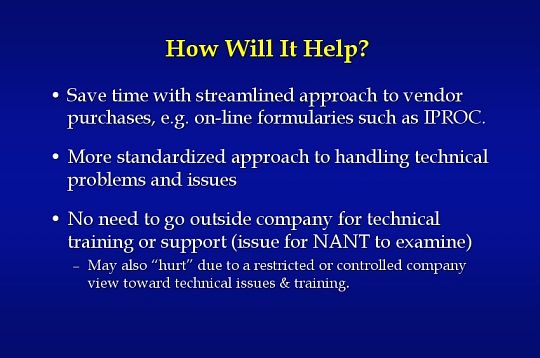

• You may save time with a streamlined approach to vendor purchases resulting from the use of on-line formularies such as the DaVita IPROC system.

• You may find that there is a more standardized approach to handling technical problems and issues.

• There will be no need to go outside the company for technical training or support.

This may also “hurt” technicians as a result of a restricted, limited, and controlled company view toward technical issues & training. This is an issue for NANT to examine. It will come up again on one of the following slides.

• You may find that there is a more standardized approach to handling technical problems and issues.

• There will be no need to go outside the company for technical training or support.

This may also “hurt” technicians as a result of a restricted, limited, and controlled company view toward technical issues & training. This is an issue for NANT to examine. It will come up again on one of the following slides.

Okay. Let’s take a look at how the consolidation and regulatory changes can be expected to hurt technicians and technologists:

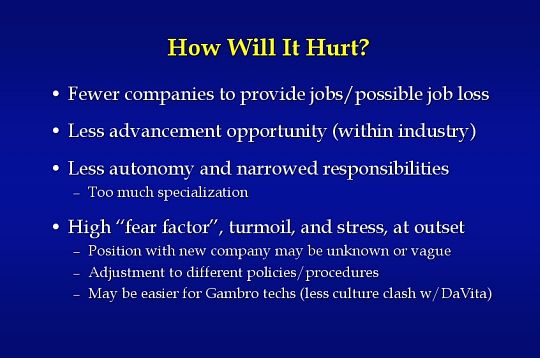

• There will be fewer companies to provide jobs and there may be a possible net job loss overall.

• With fewer dialysis providers, there will be less advancement opportunity industry wide.

The following points refer to the work environment in the consolidated companies:

• Expect less autonomy and narrowed responsibilities as a result of too much specialization.

• There may be a high "fear factor", turmoil, and stress, at the outset due to:

- The position with new company being unknown or vague, adjustments to different policies and procedures, etc.

- It may be easier for former Gambro techs as there may be less culture clash with DaVita.

• There will be fewer companies to provide jobs and there may be a possible net job loss overall.

• With fewer dialysis providers, there will be less advancement opportunity industry wide.

The following points refer to the work environment in the consolidated companies:

• Expect less autonomy and narrowed responsibilities as a result of too much specialization.

• There may be a high "fear factor", turmoil, and stress, at the outset due to:

- The position with new company being unknown or vague, adjustments to different policies and procedures, etc.

- It may be easier for former Gambro techs as there may be less culture clash with DaVita.

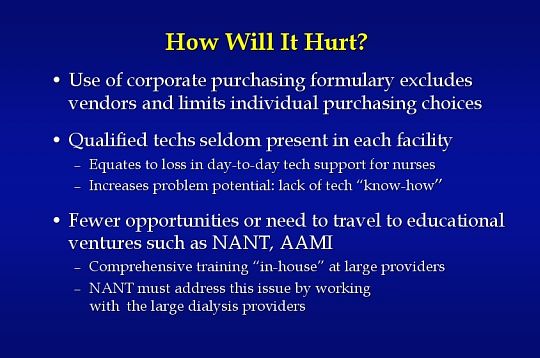

• The use of a corporate purchasing formulary excludes vendors and limits individual purchasing choices

• Due to centralization, qualified techs may seldom be present in each facility

- This equates to a loss in day-to-day technical support for nurses and increases the potential for problems from a lack of tech "know-how" on-site.

• There will be fewer opportunities or need to travel to educational ventures such as NANT and AAMI because most training will be "in-house" at the mega-providers.

- NANT must address this issue by working closely with large dialysis providers.

• Due to centralization, qualified techs may seldom be present in each facility

- This equates to a loss in day-to-day technical support for nurses and increases the potential for problems from a lack of tech "know-how" on-site.

• There will be fewer opportunities or need to travel to educational ventures such as NANT and AAMI because most training will be "in-house" at the mega-providers.

- NANT must address this issue by working closely with large dialysis providers.

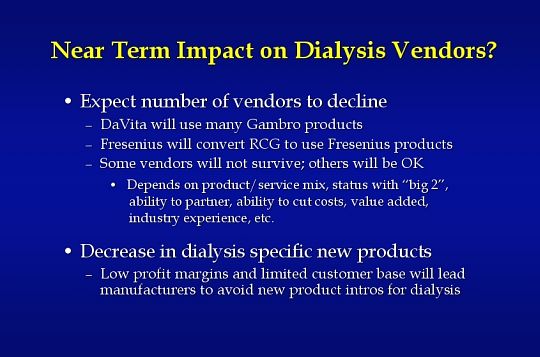

..and what will be the near term impact on your vendors?

• Expect the number of vendors to decline

- DaVita will convert to the use of many Gambro products.

- Fresenius will convert RCG to use Fresenius products.

- Because of this, some vendors will not survive; others will be OK.

- It will depend on the vendors’ product & service mix, status with the "big 2" the ability to partner, ability to cut costs, value added offerings, industry experience, etc.

• Expect a decrease in the introduction of dialysis specific new products

- Low profit margins and a limited customer base will lead manufacturers to avoid new product intros for dialysis.

• Expect the number of vendors to decline

- DaVita will convert to the use of many Gambro products.

- Fresenius will convert RCG to use Fresenius products.

- Because of this, some vendors will not survive; others will be OK.

- It will depend on the vendors’ product & service mix, status with the "big 2" the ability to partner, ability to cut costs, value added offerings, industry experience, etc.

• Expect a decrease in the introduction of dialysis specific new products

- Low profit margins and a limited customer base will lead manufacturers to avoid new product intros for dialysis.

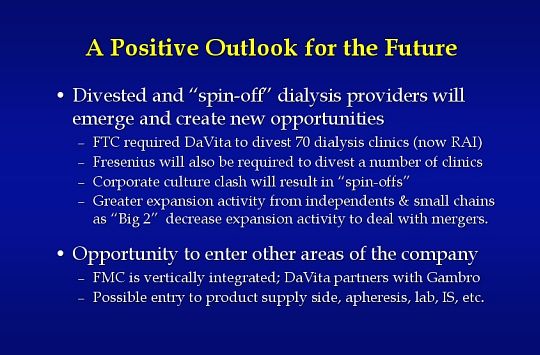

Let’s close with a positive outlook for the future:

• Divested and "spin-off" dialysis providers will emerge and create new opportunities

- The Federal Trade Commission required DaVita to divest 70 dialysis clinics (now Renal Advantage).

- Fresenius will also be required to divest a number of clinics.

- Corporate culture class will result in "spin-offs".

- There will be greater expansion activity from independents & small chains as the "Big 2" decrease their expansion activity to deal with the mergers.

• There will be opportunities to enter other areas of the large consolidated companies

- FMC is vertically integrated; DaVita partners with Gambro. This may facilitate entry to areas of the companies such as the product supply side, apheresis, lab, information systems, etc.

• Divested and "spin-off" dialysis providers will emerge and create new opportunities

- The Federal Trade Commission required DaVita to divest 70 dialysis clinics (now Renal Advantage).

- Fresenius will also be required to divest a number of clinics.

- Corporate culture class will result in "spin-offs".

- There will be greater expansion activity from independents & small chains as the "Big 2" decrease their expansion activity to deal with the mergers.

• There will be opportunities to enter other areas of the large consolidated companies

- FMC is vertically integrated; DaVita partners with Gambro. This may facilitate entry to areas of the companies such as the product supply side, apheresis, lab, information systems, etc.

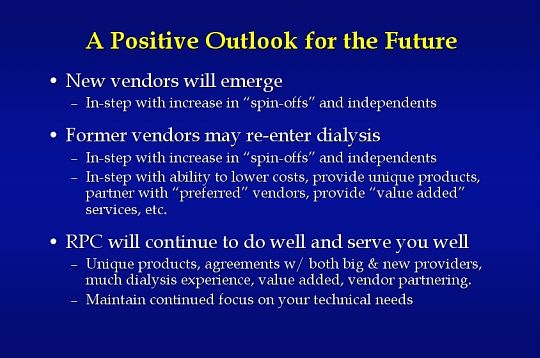

• New vendors will emerge in-step with the increase in "spin-offs" and independents.

• Former vendors may re-enter dialysis in-step with the increase in "spin-offs" and independents, and in-step with the vendor’s ability to lower costs, provide unique products, partner with "preferred" vendors, provide "value added" services, etc.

How will RPC fare and what can you expect from RPC going forward?

• RPC will continue to do well and serve you well. We are able to do this because we offer many unique products, we have agreements with both consolidated & new providers, our personnel have a great deal of dialysis experience to support you, we have value added offerings, we partner with other key vendors, and most importantly…we maintain a continued focus on your technical needs.

No doubt there are many overall positives not outlined in these slides. What can you add to this?

Please share your response during the question & answer period. Thank you.

• Former vendors may re-enter dialysis in-step with the increase in "spin-offs" and independents, and in-step with the vendor’s ability to lower costs, provide unique products, partner with "preferred" vendors, provide "value added" services, etc.

How will RPC fare and what can you expect from RPC going forward?

• RPC will continue to do well and serve you well. We are able to do this because we offer many unique products, we have agreements with both consolidated & new providers, our personnel have a great deal of dialysis experience to support you, we have value added offerings, we partner with other key vendors, and most importantly…we maintain a continued focus on your technical needs.

No doubt there are many overall positives not outlined in these slides. What can you add to this?

Please share your response during the question & answer period. Thank you.